I'm a big fan of rule-based policy over discretion-based policy. This is especially important in areas which 1) inherently have a lot of uncertainty and 2) affect lots of people, such as fiscal, monetary, and regulatory policy.

Rules are a predetermined, objective and comprehensive set of responses to changes in inputs (e.g. changes in economic conditions). You should think of rules as computer-implementable replacements for human policymakers. This has advantages in reducing uncertainty, encouraging transparency to the public, enforcing government discipline, being resistant to time inconsistent behavior and providing optimal economic policy.

Rational Expectations vs. Uncertainty

One of the most important foundations of modern economics is that individual agents (me, you, workers, corporations, etc.) are rational and will discount future expectations. Thus, one of the most important channels in which government policy acts is through expectations management. If you expect interest rates to go up in the future, you will borrow more now. If you expect taxes to go down, you will defer consumption for later. And so on.

Uncertainty about future policy prevents these channels from working correctly. After all, in order to discount future expectations, you need to know what policy will look like in the future. Uncertainty, at best, undermines the public's confidence in politicians and at worst, can cause or deepen a recession (e.g. by essentially freezing consumers and producers in place). Furthermore, when a fundamental assumption of modern economics, rational expectations, is no longer true, most economic theories fall apart.

Monetary Policy

Monetary policy refers to the central bank's actions of controlling the money supply, usually through targeting interest rates. Expansionary monetary policy refers to increasing money supply and lower interest rates, which leads to higher levels of economic growth at the cost of higher inflation. Contractionary policy refers to decreasing money supply and higher interest rates, which lead to lower economic growth with lower inflation (or deflation, negative inflation).

Currently, how monetary policy works is that Chairman Bernanke calls a closed-door meeting with the rest of the Federal Reserve Board of Governors. After the meeting, they issue a short one page press release immediately. Three weeks later, they release the more in-depth minutes. Scores of private economists and consultancies make their business forecasting Fed policy through official and unofficial statements by Fed officials. Even minor word changes between successive press releases, such as from "growth in business fixed investment appears to have slowed" and "growth in business fixed investment has slowed" are analyzed and interpreted.

In contrast, the Taylor rule replaces a discretionary interest rate regime with a simple three-variable equation (inflation, real rates, and GDP). In a Taylor rule regime, a computer collects data for the inputs, plugs it in, calculates the equation output, which is set as the new interest rate. The parameters and data are publicly available, so the people can easily follow along in real-time.

Nobel Prize-winner Milton Friedman also had an even simpler rule: you simply grow the money supply at k percent. If a rule is too complicated or has too many parameters, that just replaces the original source of uncertainty for new ones. Friedman understood this well with his simple k-percent rule.

Rules are especially applicable to monetary policy since the Fed is constantly playing a game of "expectations management" with the public. If you ever read Fed minutes or listen to Fed statements, you will know how often they emphasize maintaining credibility. This is how it works: monetary policy is credible because people believe it works because people believe monetary policy is credible because monetary works because...

The moment that the public stops believing in the Fed's promise to maintain its commitment to price stability is the moment that prices become unstable. Bernanke's claim that he will keep rates low until 2015 is not credible, simply because he will leave office in 2014. However, if a computer program were Chairman instead, its forecasts of its future actions would be credible (provided someone locked the computer and threw the password away to prevent tampering), because the public would know exactly what the computer program is likely do, since its programming would be transparent and open to the public.

The main problem is that it's difficult to say what is the best rule. Should we follow Taylor or Friedman? Evan's rule? NGDP target? Or something completely different?

Fiscal Policy

Fiscal policy refers to government spending and (tax) revenue collection. Expansionary fiscal policy refers to increasing spending and/or decreasing taxes, which creates deficits, runs up debt and boost the economy. Contractionary policy refers to decreasing spending and/or increasing taxes, which creates surpluses, decreases debt and slows down the economy.

Deficits aren't bad in and of themselves, if they are balanced by surpluses in other years. Unfortunately, governments tend to have a bias towards deficits. One reason is that politicians like to boost the economy in order to ensure re-election. Another reason is because deficit spending is a transfer of wealth from young generations to old generations, and politicians tend to belong to the latter.

One way to think of debt is your present-self borrowing from your future-self. It might seem that your creditor is your direct lender (bondholder, credit card companies, mortgage banks, etc.). However, they are merely middlemen between your present-self and your present-self's ultimate creditor, your future-self. In developed nations, older demographics tend to see most of the immediate payoff of government spending (social security, medicare, etc.) and furthermore, they will unlikely be around when debts need to be paid off.

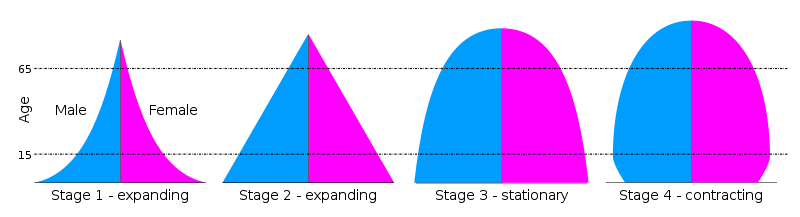

Thus, deficit spending is a transfer of wealth from the future (young) to the present (old). Older generations tend to be more politically established than younger generations (the average age of a US congressmen is around sixty). Of course, none of this is a problem when economies are developing and there are much more young than old (as in the leftmost pyramid). However, what happens when an economy stops being youthful (as in the rightmost pyramid)?

Fiscal rules can be thought of limits on either the spending side and/or the tax side. Some types of rules that you may already know about are 1) balanced budget amendments and 2) debt ceilings.

A balanced budget amendment would require non-negative deficits in every year. The problem with this type of policy is that it's inflexible and inherently pro-cyclical. Since in recessions, real incomes fall, tax revenues fall, which necessitates an increase in the tax rate in order to maintain tax revenues. Ideally, a rule should be counter-cyclical.

You may already be familiar with the US debt ceiling debacle of Summer 2011. The problems with this type of rule are that there has been no real consequences for missing it (not for the better part of the past century at least), and as a result, the debt ceiling has been raised 74 times. This is the equivalent of setting a clock alarm in order not to be late for work, but upon waking, hitting the snooze button about a dozen times. If your clock didn't have a snooze button, you wouldn't be so ready to fall back to sleep upon hearing the alarm go off. Ironically, the very existence of a snooze button decreases your willingness and ability to rise in the morning. Thus, in addition to being counter-cyclical, the ideal rule needs to be credible and thus, difficult to change.

Unfortunately, most of these rules are determined on an aggregate top-down level, and thus, have no meaning to individual lawmakers. Instead, spending increases and cuts can be (and frequently are) decided bill by bill. A lawmaker's immediate interests lie not in meeting some high-level target, but rather, in ensuring he gains federal funding for his pet projects. Thus, rules should instead target individual legislation rather than annual aggregates.

For example, one favorite idea of mine is that legislation needs to come in pairs: spending bills must be accompanied with revenue (tax, etc) bills. The exact proportion doesn't have to be dollar for dollar. In fact, you could have an independent board target the spending:revenue ratio, somewhat like a fiscal Fed. For example, a Keynesian board would dictate a spending:revenue ratio >1 during economic slowdowns and a ratio <1 during economic booms, in true counter-cyclical style.

Algo-Government

While the prospect of electing computers to presidential office may never come, there are places for strict but transparent algorithms in government. This reduces uncertainty about government policy, allowing rational expectations to work and making purchasing and investment decisions easier for both consumers and producers. As political gridlock is unlikely to go away for the foreseeable future, continuing uncertainty over fiscal issues (such as the fiscal cliff) and monetary policy (such as the end of Bernanke's term in 2014) shows that discretionary policy is mainly just terrible policy.

interesting thought- rule based but probabilistic. So eg: given this economic output level (inflation and unemployment input parameters), then I will hike rates 25bps with 10% chance, and 50bps with 5% chance, and stay with 75% chance. And just roll the dice. I like this, but prob doesn't help solve uncertainty. Kinda reminds me of your probabilistic bank checking acct guarantee idea.

ReplyDeletebtw- I think you should highlight/underline what you think are important conclusions/findings.

Problem with rule based is that people at the Fed will be out of a job! So that will never happen. If you say that you still need people there to monitor the rule (in case of exceptional circumstances etc) then the rule itself is uncertain (ie. might get taken off if "exceptional circumstance") so then there is uncertainty in monetary policy anyways.

btw- I did not know this:

"Currently, how monetary policy works is that Chairman Bernanke calls a closed-door meeting with the rest of the Federal Reserve Board of Governors. If a change in policy is deemed necessary (such as the start of QE3), they issue a press release immediately after the meeting. Otherwise, they release the minutes with a three week lag. "

Not sure what the point is of your probabilistic monetary policy. If the goal is to reduce uncertainty, that doesn't really help.

ReplyDeleteI agree that this post was a bit long... what do you think I should highlight?

I agree that rules could be uncertain... that's why you need real consequences/strict limits on when to deviate from rules. Something hard-written into the Fed mandate. Meta-rules, if you will.

I was wrong about the Fed thing - forgot to update that. They always release FOMC statements immediately and minutes with a 3w lag, regardless of change in policy.