Sorry for the lack of posts recently. I've been busy cramming for the CFA.

One of my favorite newsletter writers does something he calls the "Speed Round" in which he shoots out somewhat random short paragraphs or one-liners. I have many (but not quite fifty) thoughts that aren't worthy of expanding into standalone posts (rather, I'm just too plain lazy). So, here's my dollar:

Politics

This was the first political election I ever really paid attention to. What do I have to show for it? I'm a marginally more knowledgeable but much less happy person. Unfortunately, ignorance was bliss.

Ron Paul

Ron Paul's final term as Congressman is coming to an end. I have mixed feelings about this. Ron Paul was a unelectable wacko, but at least he was my favorite unelectable wacko. He taught me to be skeptical of politicians, which taught me to stop believing in him. I don't think any other politician could ever give that lesson.

Democracy

In a democracy where each individual is independent and gets exactly one vote, the consensus isn't the average. It's the median.

Democracy pt. 2

The free market is a voting system where dollars are votes and what you vote on is the allocation of resources towards goods and services. The better you vote, the more votes you get back (aka return on investment). So this system tends to redistribute votes to people to vote better ("better" being defined by market consensus). In a way, it's a form of direct democracy.

Democracy pt. 3

One problem with the free market is that some people start out life with much more "votes" than others (e.g. Mitt Romney). High inheritance and estate taxes would eliminate this anti-competitive behavior. Thus, the only people who would have a lot of "votes" would be those who accumulated them throughout their lives. It's kind of like anti-trust law, except against individuals instead of monopolies.

What about people on the other end of the spectrum? A minimum level of "votes" per person could be guaranteed through cash transfers to the qualifying poor. This is another reason why cash transfers should be preferred to direct handouts of goods and services. A government-mandated mix of goods and services in place of cash transfers denies the poor this voting opportunity.

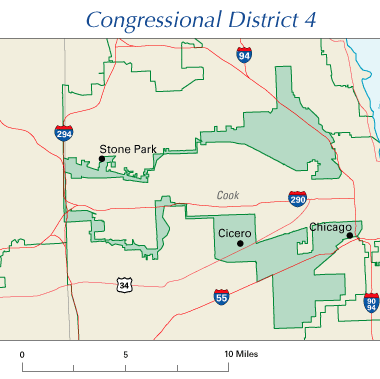

Gerrymandering

Awesome word attached to a ridiculous practice: manipulating the geographic boundaries of electoral districts in order to gain a political advantage. The name comes from Elbridge Gerry, who was a notorious gerrymander-er (although not the first) and salamander, which was the shape of his contorted districts.

In green is Illinois's 4th congressional district. (Note: this is one single district, not two)

Here's a 2002 piece by The Economist on this practice. Their subtitle: "In a normal democracy, voters choose their representatives. In America, it is rapidly becoming the other way around."

Ethical Utilitarianism

The Life You Can Save is kind of like the Bill Gates-Warren Buffett Giving Pledge, except for normal people. It's a pledge to donate a portion of your income to charity. They suggest a very modest 1% for those who make less than $105k (Buffett is pledging 99% of his wealth to philanthropy). I've taken the pledge. You should too.

On a similar note, unless you're an ancient Egyptian, everyone should be organ donors on their driver's license. If you're not convinced, read this letter from Ken Kesey, the author of One Flew Over the Cuckoo's Nest.

Awareness Days

There are too many "awareness" days. For example, there's a "Pregnancy and Infant Loss Awareness Day", a "Stillbirth and Infant Loss Remembrance Day", and a "Pregnancy and Infant Loss Awareness Month"... none of which I was aware of. If you take a good idea ("let's have more awareness days!") to its logical extreme ("let's have as many awareness days as possible!"), sometimes you make things worse.

Every decision you make in life is an implicit bet. Even the lack of a decision is a bet (a bet against all alternatives). There are certain large bets that almost everyone makes in their lives: choice of career, renting vs home-ownership, buying a car, etc. which give you concentrated exposure to a few extraneous risk factors. It's important to recognize what these risk factors are, and consider ways to fully or partially hedge against these risks if they are unwanted.

Hedging is also known as insurance. The basic principle to hedging is to place an opposite, offsetting bet. Some basic terms: being "long"/"short" means to bet that something will go up/down, respectively. For example:

- If you have a job, you are implicitly "long" 1) your employer, and 2) your industry. To hedge, you should "short" the stock prices of your employer and your industry.

- If you buy a house, you should short real estate.

- If you frequently drive, you should go long oil prices.

- There's a site that lets you hedge against bad grades.

- Finally, you can simply make more diversified decisions in life. For example, diversifying your skill set will expand the number of industries that will employ you, thus de-concentrating your career risk.

To take a historical view, a typical construction worker-homeowner-car driver in the mid-2000s had huge risk exposures to the real estate and gas prices. Needless to say, he didn't do very well in the simultaneous housing/energy crisis of 2008.

Diversification and risk management do not merely apply to investment portfolios.

grade insurance

ReplyDeletelol interesting. i've seen a get rewarded if good grade website before, but never a get insurance for bad grade. no way to stop people from purposely doing badly though? i'm assuming they just limit the amt you can bet.